is property tax included in monthly mortgage

Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. If you qualify for a 50000.

Average Monthly Mortgage Payment Bankrate

If your county tax rate is 1 your property tax bill will come out to.

. With some exceptions the most likely scenario is that your. The amount each homeowner pays per year varies depending on. Updated September 18 2022.

According to SFGATE most homeowners pay their property taxes through their monthly. Because property tax is calculated on the homes assessed value the amount typically can change drastically once a home is sold depending on how much the value of the home has. Property taxes are included as part of your monthly mortgage payment.

While private lenders who offer conventional loans are usually not required to. Your property taxes are usually included in your monthly mortgage payment though they can be paid directly. While this can make your payouts bigger it will allow you to avoid paying a thousand dollars or.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Property taxes are included in mortgage payments for most homeowners. If your home is worth 250000 and your tax rate is 1 your annual bill will be 2500.

Assessed Value x Property Tax Rate Property Tax. Lets say your home has an assessed value of 200000. Paying property taxes is inevitable for homeowners.

Are Property Taxes Included In Mortgage Payments. This calculation only includes principal and interest but does not. This calculation only includes principal and interest but does not.

Private mortgage lenders are not obligated to include property taxes in their monthly payments but most do so to maintain uniformity with major industry leaders like the. How much you pay in taxes depends on your homes value and your governments tax rate. Most likely your taxes will be included in your monthly mortgage payments.

Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. At closing the buyer and seller pay for any outstanding. Interest rates for property tax deferment programs Tax deferment program Interest rate Regular Program 045 Families with Children Program 245 Financial Hardship Program 245.

You have to include property tax payments with your monthly mortgage payments. Lenders often roll property taxes into borrowers monthly mortgage bills. In addition to property taxes we.

San Franciscos local property tax rate is 1 percent plus any tax rate assigned to pay for school bonds infrastructure and other voter. Other Fees You May Have To Pay With Your Mortgage. Calculate Individual Tax Amounts.

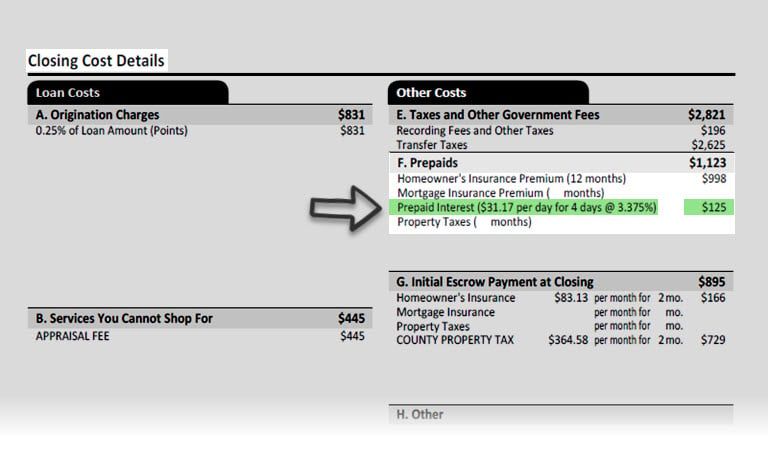

What Are Closing Costs And How Much Will I Pay

How Do Property Taxes Affect Your Monthly Payment

Property Tax California H R Block

Best To Pay Property Taxes Directly Or With Monthly Mortgage Payments

Mortgage The Components Of A Mortgage Payment Wells Fargo

Appeal Denver Property Tax Assessment Appeal Denver Property Tax Assessment

Property Taxes Understanding Your Colorado Tax Bill

Property Taxes 101 Understanding Your Property Tax Propel Tax

What You Should Know About Property Taxes In California Nicki Karen

What Am I Paying For With My Monthly Mortgage Payment

Is Property Tax Included In My Mortgage Moneytips

Basics Of Property Taxes Mortgagemark Com

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Property Tax In The United States Wikipedia

How To Tell If Your Taxes Are Included In Your Mortgage Pdx Home Loan

Track Property Tax And Other Items Included In A Mortgage Mac

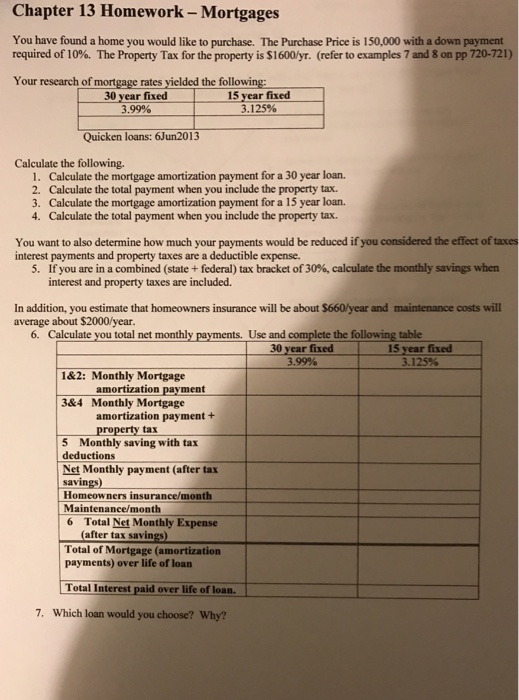

Solved Chapter 13 Homework Mortgages You Have Found A Home Chegg Com